India’s startup ecosystem has experienced explosive growth in recent years, transforming the nation into a global hub for innovation and entrepreneurship. With over 60,000 startups recognized by the Department for Promotion of Industry and Internal Trade (DPIIT), India has become the third-largest startup ecosystem in the world, following the United States and China. In 2023 alone, Indian startups raised approximately $42 billion in funding, showcasing the immense potential and investor confidence in this burgeoning sector.

India is witnessing growth across sectors but currently the upcoming sectors are Spacetech, Defencetech, Fintech, Insuretech AI/ML

-Anil Joshi, Unicorn India Ventures

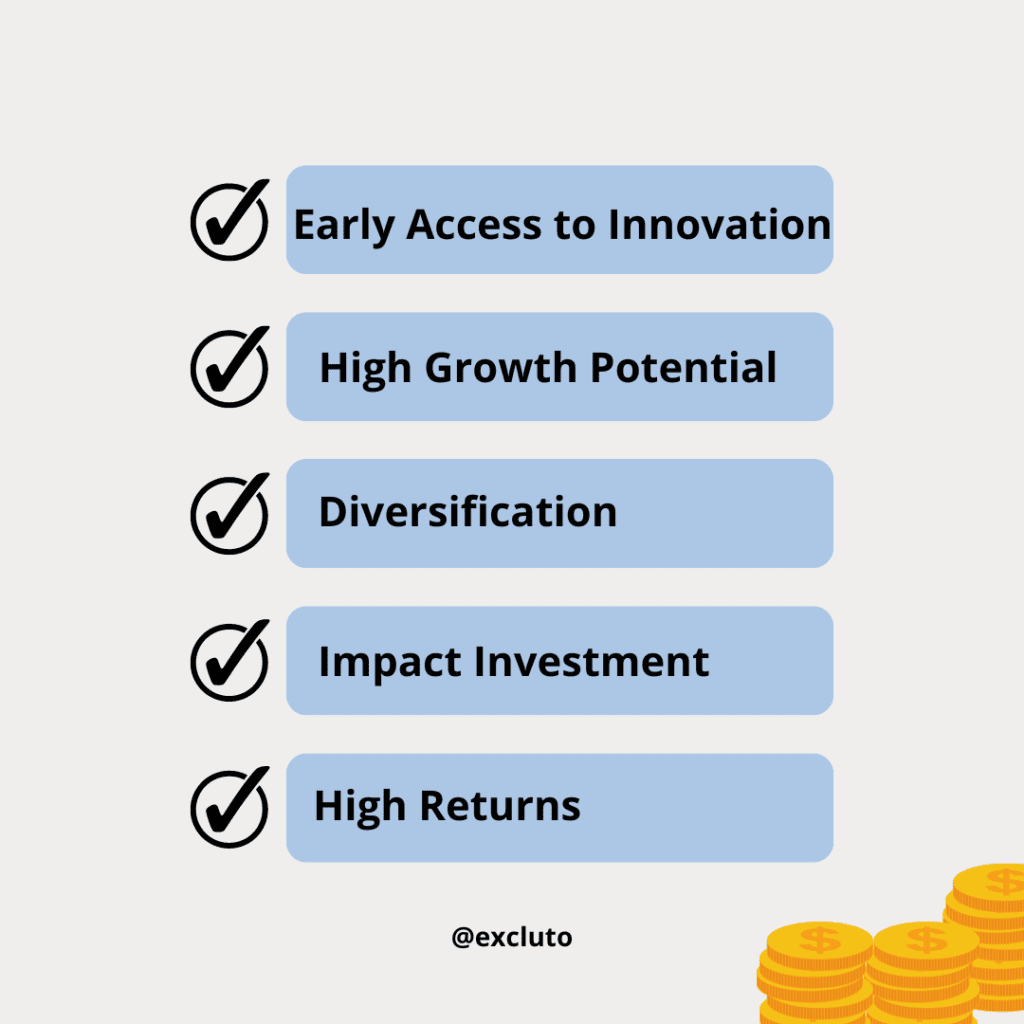

Why Invest in Startups via the Venture Capital Route?

Investing in startups through venture capital offers several compelling advantages:

1. High Growth Potential: Startups have the potential for exponential growth, often disrupting traditional industries and creating new market opportunities.

2. Early Access to Innovation: Venture capitalists gain early access to cutting-edge technologies and innovative business models, positioning themselves at the forefront of industry transformations.

3. Diversification: Venture capital funds typically invest in a diversified portfolio of startups, spreading risk across various sectors and stages of development.

4. Impact Investment: Many startups focus on solving critical societal challenges, offering investors the chance to contribute to positive social and environmental impacts while achieving financial returns.

5. High Returns: Historically, venture capital investments have yielded significant returns, particularly in high-growth sectors like technology and healthcare.

6. Mitigate Risk: While the asset class is high yield, asset class, it is equally risky, hence investing through venture capital funds helps mitigate the risk as they manage the portfolio professionally and are trained to run it professionally

7. Managing Portfolio: With time the portfolio becomes big and difficult to manage, Venture Capital not only manages the portfolio but also shares regular updates for better portfolio management

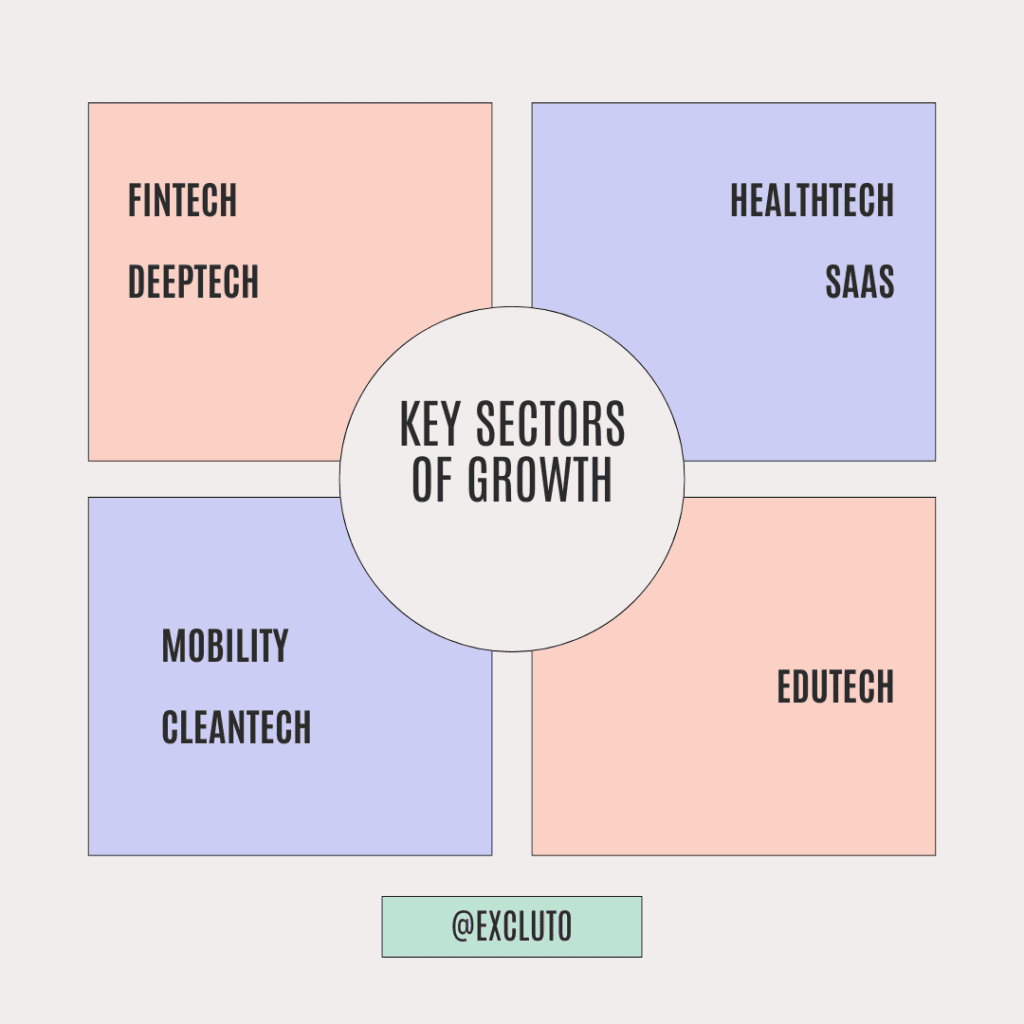

Key Sectors of Growth

1. FinTech

India’s FinTech sector has revolutionized financial services, offering innovative solutions in digital payments, lending, insurance, and wealth management. With a market size projected to reach $150 billion by 2025, early investments in FinTech startups like Paytm, Razorpay, and Zerodha have already yielded substantial returns for venture capitalists.

2. DeepTech

DeepTech encompasses startups that leverage advanced technologies such as artificial intelligence, machine learning, blockchain, and quantum computing. These startups are pushing the boundaries of innovation in industries like cybersecurity, healthcare, and autonomous systems. India’s DeepTech ecosystem is growing rapidly, with notable startups like SigTuple and Qure.ai attracting significant venture capital funding.

3. HealthTech

The HealthTech sector has seen accelerated growth, driven by the increasing demand for digital health solutions and telemedicine. Startups like Practo, CureFit, and 1mg are transforming healthcare delivery, offering scalable and efficient solutions. The Indian HealthTech market is expected to grow to $21 billion by 2025, providing ample opportunities for early-stage investors.

4. SaaS (Software as a Service)

India has emerged as a global leader in SaaS, with startups offering cloud-based software solutions for businesses worldwide. The sector is expected to reach $50 billion by 2025, with successful startups like Freshworks, Zoho, and Chargebee setting the benchmark for growth and profitability.

5. Mobility

Mobility startups are redefining transportation in India, focusing on electric vehicles (EVs), shared mobility, and smart transportation solutions. With government incentives and a growing awareness of sustainability, startups like Ola Electric, Bounce, and Ather Energy have attracted significant venture capital investments.

6. CleanTech

CleanTech startups are at the forefront of addressing climate change and environmental sustainability. Innovations in renewable energy, waste management, and sustainable agriculture are gaining traction. Startups like ReNew Power and UrbanClap (now Urban Company) are leading the charge, offering lucrative investment opportunities in the CleanTech sector.

7. EduTech

The EduTech sector has witnessed unprecedented growth, especially during the COVID-19 pandemic. Startups like Byju’s, Unacademy, and Vedantu are revolutionizing education delivery through digital platforms. The Indian EduTech market is projected to reach $10 billion by 2025, presenting attractive prospects for venture capitalists.

Case Studies of Successful Venture Capital Investments

1. Paytm

Paytm, a leading digital payments and financial services platform, has grown exponentially since its inception. Early investments from venture capital firms like SAIF Partners and Alibaba Group played a crucial role in its expansion. In 2021, Paytm went public with a valuation of $16 billion, delivering substantial returns to its early investors.

2. Freshworks

Freshworks, a SaaS company providing customer engagement solutions, secured early-stage funding from venture capital firms like Accel and Sequoia Capital. In 2021, Freshworks became India’s first SaaS unicorn to be listed on the Nasdaq, with a market capitalization of over $10 billion, offering impressive returns to its investors.

3. Ola Electric

Ola Electric, an EV startup, received early investments from Tiger Global and Matrix Partners. The company’s innovative approach to sustainable transportation and strong growth trajectory led to a valuation of over $5 billion, highlighting the potential of venture capital investments in the mobility sector.

Conclusion

The Indian startup ecosystem offers a wealth of opportunities for early-stage investments through venture capital. With sectors like FinTech, DeepTech, HealthTech, SaaS, Mobility, CleanTech, and EduTech poised for significant growth, investors can achieve substantial returns while contributing to innovation and societal progress.

Unicorn India Ventures: Leading the Way

Unicorn India Ventures is dedicated to investing in the growth and success of early-stage startups. They allocate 20% of their corpus to creating a diversified portfolio of investments, leading the initial rounds of pre-Series A funding with investment sizes ranging from $0.5 Mn to $2 Mn. The remaining portion of their fund is directed towards backing successful companies that emerge from their portfolio.

The fund managers are part of the ecosystem for over 20 years and are well networked to source the investment opportunities. UIV is one of the unique fund which has investment across India and that has happened due to unique ability to source the deal through out India. OpenBank, Smartcoin, Genrobotic, & Sequretek are some our unique case studies.

– Anil Joshi, Unicorn India Ventures

Unicorn India Ventures believes in working closely with founders to provide the support they need to thrive. They offer financial, business, and operational support to help startups overcome unique challenges and drive growth. Their approach, built on decades of experience across various domains, allows them to understand and solve problems at the grassroots level. Encouraging startups to experiment and explore innovative solutions, Unicorn India Ventures strives to build long-term relationships with their portfolio companies.