India is a rapidly growing economy, but it faces the challenge of the “middle-income trap,” a situation where countries stagnate at middle-income levels without advancing to high-income status.

This issue poses significant risks to sustained economic growth and development. However, strategic venture capital (VC) investments can provide a pathway for India to escape this trap. Here’s a closer look at how VC investments can drive transformation and economic progress in India.

Understanding the Middle-Income Trap

The middle-income trap is characterized by:

– Stagnant Productivity: Slowed productivity growth as economies mature.

– Declining Competitiveness: Increased competition from lower-cost economies.

– Innovation Deficit: Insufficient innovation to drive global competitiveness.

In India, this trap is evident as the country grapples with challenges like slow productivity growth and uneven economic development.

According to the World Bank, India’s per capita GDP growth has slowed from 8.3% in 2010 to around 4.5% in recent years, highlighting the need for new strategies to break through this stagnation.

Strategic VC Investments: A Pathway to Growth

1. Driving Innovation and Technology Adoption

Venture capital investments can spur innovation by funding startups that introduce new technologies. For example, India’s Paytm, a fintech unicorn, has received over $2 billion in VC funding. Paytm’s digital payment solutions have revolutionized financial transactions in India, enhancing financial inclusion for millions.

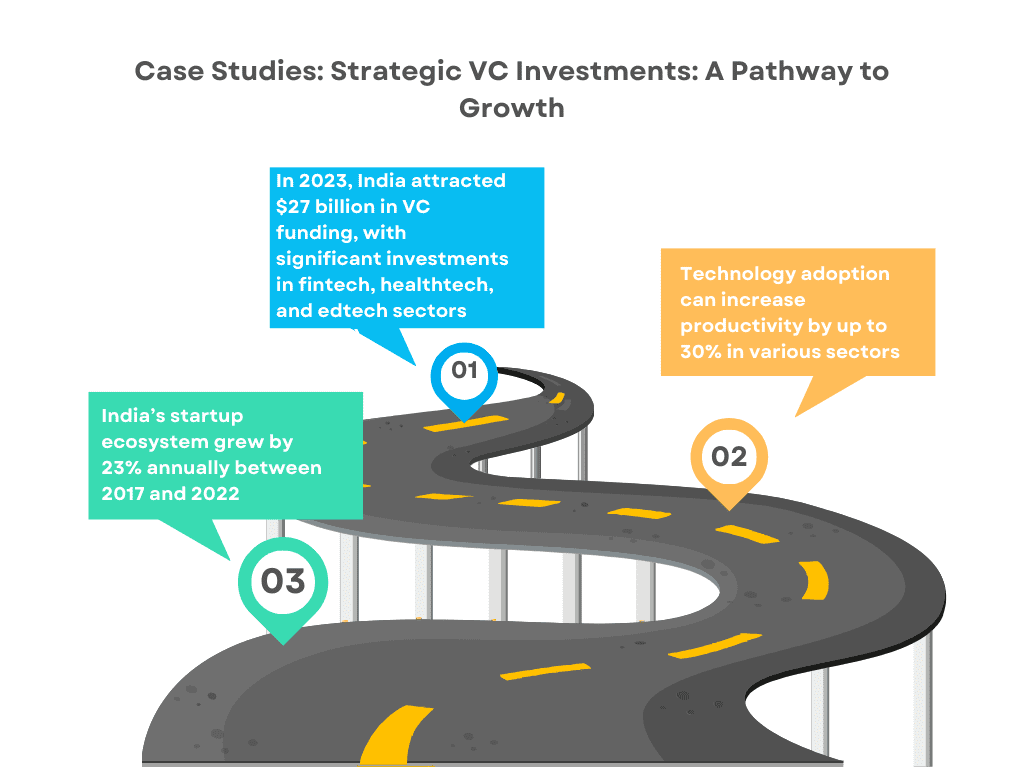

Fact: In 2023, India attracted $27 billion in VC funding, with significant investments in fintech, healthtech, and edtech sectors (Tracxn).

2. Enhancing Productivity and Efficiency

Investing in startups that focus on productivity-enhancing technologies can boost India’s economic performance. Freshworks, a SaaS provider, raised $100 million in a Series G round and has significantly improved customer relationship management for businesses worldwide. Such investments enhance operational efficiency and contribute to economic growth.

Data Point: According to a McKinsey report, technology adoption can increase productivity by up to 30% in various sectors, offering substantial growth potential for India.

3. Fostering a Robust Startup Ecosystem

A vibrant startup ecosystem creates jobs, fosters entrepreneurship, and attracts foreign investment. In India, the success of startups like Zomato and Ola demonstrates the impact of VC funding. Zomato, a food delivery platform, raised over $2 billion in funding and expanded globally, while Ola, a ride-hailing service, has transformed urban mobility in India.

Case Study: India’s startup ecosystem grew by 23% annually between 2017 and 2022, supported by increased VC investments and government initiatives (NASSCOM).

Case Studies of Successful VC-Backed Transitions in India

1. India’s Digital Revolution

India’s investment in digital technology has been pivotal in its economic transformation. Jio, backed by Reliance Industries and strategic investments, has disrupted the telecom sector with affordable data services, driving widespread digital adoption. Jio’s entry has led to increased internet penetration and connectivity across India.

Fact: India’s internet user base grew from 500 million in 2018 to over 750 million in 2023, reflecting the impact of digital investments (IAMAI).

2. Diversifying the Economy

VC investments in diverse sectors help India move beyond traditional industries. Rivigo, a logistics startup, has raised over $200 million and transformed freight logistics with its innovative technology-driven solutions. Rivigo’s success underscores how VC funding can support new industries and drive economic diversification.

Data Point: The logistics sector in India is expected to grow at a CAGR of 10% from 2023 to 2028, driven by technology and innovation (ResearchAndMarkets).

Conclusion

Breaking free from the middle-income trap requires innovative strategies, and venture capital offers a powerful tool for India. By driving innovation, enhancing productivity, and nurturing a dynamic startup ecosystem, strategic VC investments can help India transition to high-income status.

For HNIs, investors, wealth managers, and VCs, investing in India’s emerging markets presents a unique opportunity to drive economic progress and achieve substantial returns. As India continues to evolve, focusing on venture capital investments offers both promising financial prospects and the chance to contribute to meaningful economic development.

At Excluto, we remain committed to connecting venture capitalists and investors with emerging opportunities in this dynamic ecosystem, helping them navigate and capitalize on the next wave of innovation in India, by exploring Venture Capital as an asset class.

Read More

The Future of Digital Wealth Management Platforms: Opportunities for VCs and Investors

The Role of Venture Capital in Wealth Diversification for HNIs and UHNIs