Venture capital (VC) investing has emerged as a dynamic asset class, offering both opportunities and challenges for investors seeking higher returns and involvement in cutting-edge startups. It is a passive investment strategy and involves less time involvement.

In this blog, we delve into the pros and cons of venturing into the realm of VC investing, exploring its potential benefits and drawbacks with a focus on Excluto, a leading platform in this space.

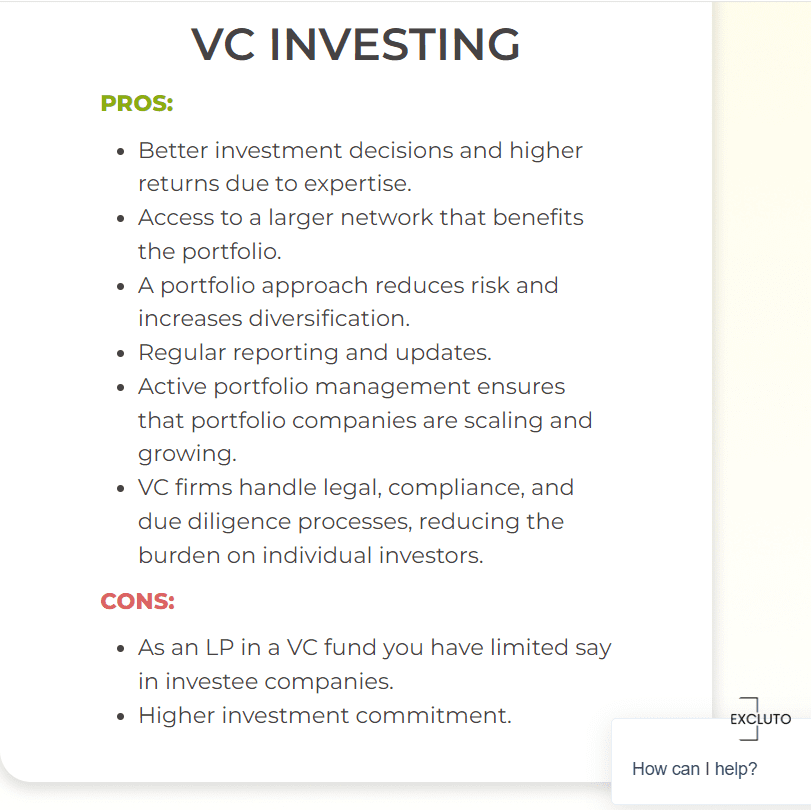

Pros:

Expertise and Higher Returns:

One of the primary advantages of VC investing lies in the expertise and experience of the fund managers. These professionals possess a deep understanding of market trends, technology landscapes, and business models, enabling them to make informed investment decisions. With their guidance, investors stand to benefit from better allocation of capital and potentially higher returns on their investments.

Access to a Vast Network:

Additionally, VC firms offer access to a vast network of resources and connections. Through strategic partnerships, introductions, and collaborations, portfolio companies gain access to crucial resources such as talent, customers, and distribution channels. This network effect not only accelerates the growth of startups but also enhances the value proposition for investors by unlocking new opportunities for growth and expansion.

Risk Mitigation through Diversification:

Furthermore, VC investing allows for portfolio diversification, mitigating risks associated with individual investments. By spreading capital across a range of startups operating in different industries and geographies, investors can minimize the impact of any single company’s performance on their overall portfolio. This diversified approach enhances resilience and improves the chances of achieving consistent returns over the long term.

Transparency and Reporting:

Moreover, VC firms typically provide regular reporting and updates to their investors, offering transparency and visibility into the performance of their portfolio companies. This ongoing communication fosters trust and enables investors to stay informed about the progress and challenges faced by the startups in which they have invested.

Efficient Management Processes:

Additionally, VC firms take on the responsibility of managing legal, compliance, and due diligence processes, alleviating the burden on individual investors. By leveraging their expertise and resources, these firms streamline the investment process and ensure that all necessary procedures are followed diligently, reducing the risk of regulatory issues or legal complications.

Cons:

Limited Control:

Despite its potential benefits, VC investing also comes with its share of challenges and limitations. One notable drawback is the limited control that investors have over the decision-making process. As limited partners (LPs) in VC funds, investors may have little to no say in the selection or management of investee companies, relying instead on the expertise and judgment of the fund managers.

Higher Investment Commitments and Longer Holding Periods:

Moreover, Venture Capital investments typically require a significant commitment of capital, often with long holding periods before realizing returns. Unlike public markets where liquidity is readily available, VC investments are illiquid and may require several years to reach maturity or exit through an acquisition or initial public offering (IPO). This extended investment horizon can pose challenges for investors seeking shorter-term returns or liquidity.

Conclusion:

In conclusion, Venture Capital investing offers a compelling opportunity for investors to participate in the growth and innovation of early-stage startups, with the potential for attractive returns over the long term. With the support of experienced fund managers and access to a diverse portfolio of companies, investors can benefit from enhanced decision-making, network effects, and risk mitigation strategies.

However, it is essential to acknowledge the limitations and challenges associated with VC investing, including limited control, higher investment commitments, and longer holding periods. By carefully weighing the pros and cons and aligning investment objectives with risk tolerance and liquidity preferences, investors can make informed decisions and harness the full potential of this exciting asset class.

With platforms like Excluto providing access to curated Venture Capital opportunities and expert guidance, investors can navigate the complexities of VC investing with confidence and capitalize on the transformative potential of early-stage innovation.